The Economics of Protein Supply in Africa: Why Supply Chains Determine Market Winners

Africa's protein markets reveal a fascinating economic paradox: the cheaper product to produce isn't always the more affordable product to buy.

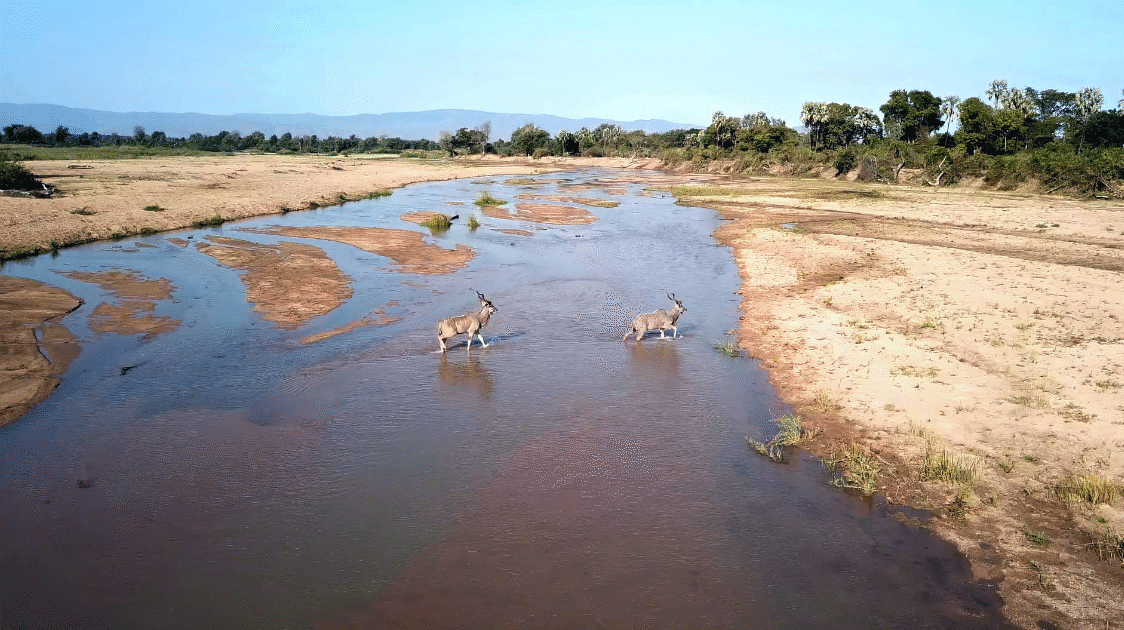

Across the continent, bushmeat and beef engage in a complex pricing dance that defies simple economic assumptions, with supply chain efficiency emerging as the decisive factor in determining which protein source dominates local markets.

This is a significant factor that is often overlooked when trying to understand the poaching threats and the economics of bushmeat poaching across the continent.

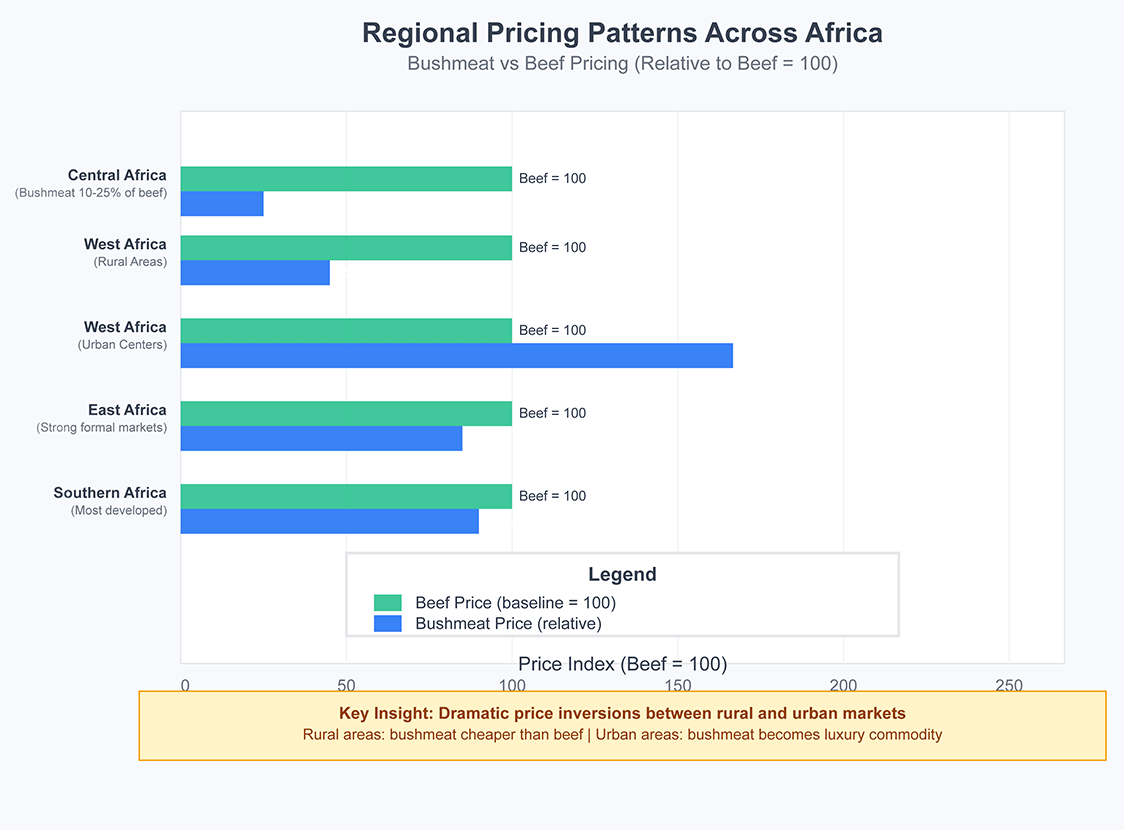

Regional Pricing Patterns Tell a Complex Story

Research across over 20 African countries reveals that protein pricing exhibits four distinct regional patterns, each influenced by infrastructure development and economic conditions. Studies documenting bushmeat consumption patterns across West and Central Africa have reported data on 177 species from 275 sites across 11 countries, collected over 30 years.

In Central Africa, bushmeat costs only 10 to 25% of the price of domestic meat substitutes, making it the most affordable protein option for millions of people.

The Central African Republic exemplifies this dynamic, where beef costs two to three times more than bushmeat, providing essential protein access for communities where 80 to 90% of animal protein comes from wildlife sources.

West African markets exhibit mixed patterns, highlighting the importance of location.

Ghana's bushmeat prices are 108% higher than those of beef in urban centers, while rural areas maintain their traditional cost advantage for wild meat.

This dramatic shift occurs within the same country, demonstrating how supply chain factors can completely invert pricing relationships over relatively short distances.

East African countries demonstrate the strongest formal beef market development, with Kenya achieving export-quality beef at $3.30 to $4.50 per kg and expanding its regional trade networks.

The infrastructure investment in cold chain logistics and formal processing facilities has created competitive advantages for beef systems that don't exist in other regions.

Southern Africa boasts the most developed formal meat sector, led by South Africa's $625 million processed meat market, which is projected to reach $940 million by 2030.

This market development reflects decades of infrastructure investment and regulatory framework development that have overcome the natural cost advantages of traditional protein sources.

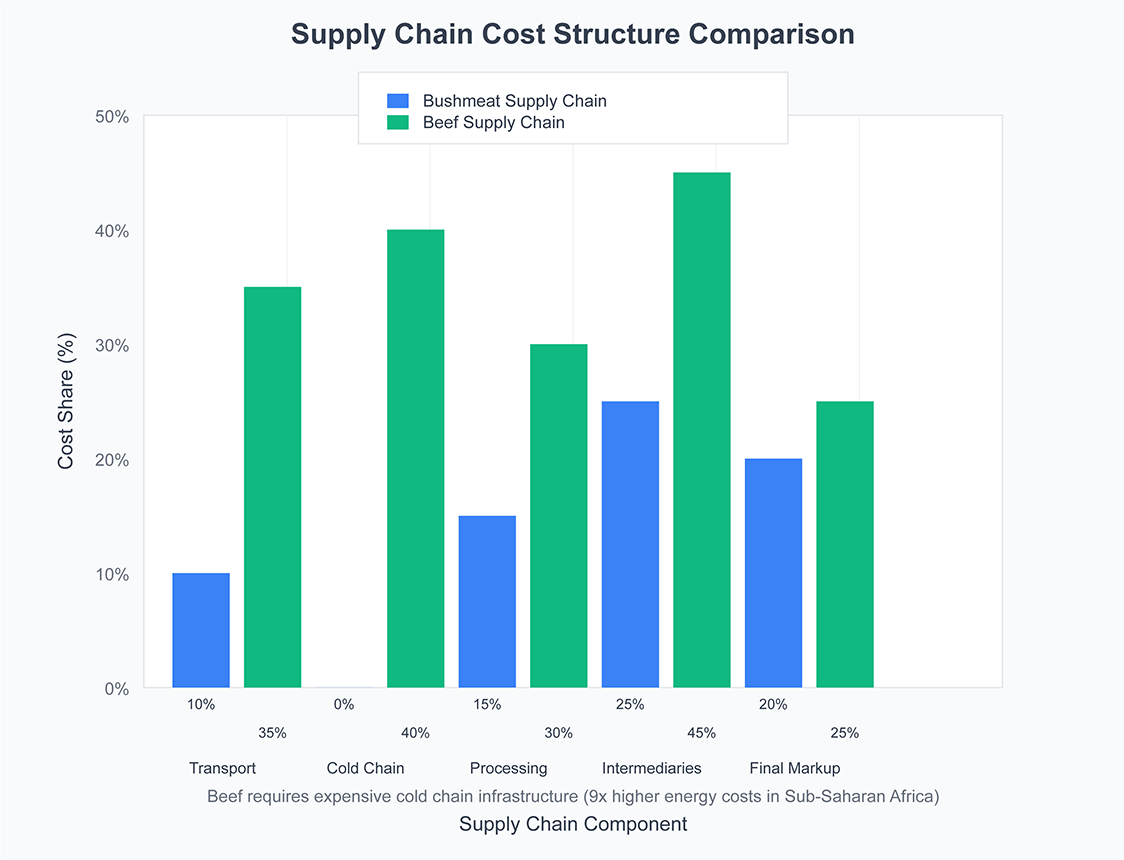

Supply Chain Efficiency: The Hidden Cost Driver

The fundamental difference between bushmeat and beef systems lies in their supply chain requirements, which create cost advantages that often outweigh production costs.

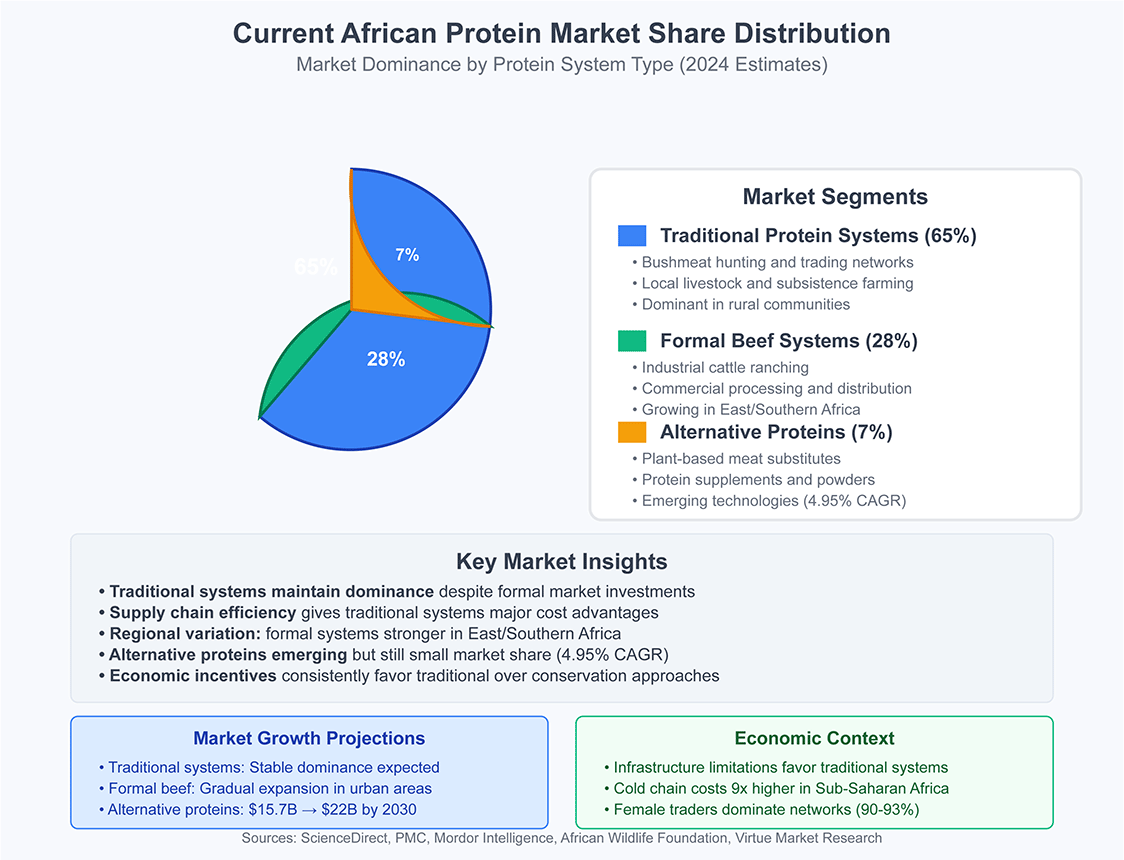

Cold chain logistics costs run 9 times higher in Sub-Saharan Africa than global averages, creating significant disadvantages for formal beef supply chains.

Energy costs for maintaining cold chains necessitate continuous refrigeration from slaughter to retail at temperatures of 2°C to 4°C, which requires expensive backup generators due to the unreliability of power grids.

Bushmeat's ambient temperature transport requirements and minimal processing needs enable direct field-to-market pathways, bypassing the need for expensive infrastructure.

Transportation costs represent the most significant differential, as bushmeat requires no cold chain infrastructure and can be transported using any available vehicle.

Preserved forms such as smoked, dried, or salted meat extend shelf life without refrigeration, creating additional cost advantages.

Processing requirements further differentiate the systems economically. Beef processing requires industrial slaughter facilities equipped with veterinary inspection, standardized butchering processes, and continuous refrigeration, resulting in high capital investment and ongoing energy costs.

Bushmeat processing employs traditional methods with minimal infrastructure, including field-edge smoking, drying, or salting, utilizing local materials at low energy costs.

Market intermediary structures also significantly affect final pricing.

Beef systems involve multiple intermediary layers, with each adding 15 to 25% markup, whereas bushmeat often follows direct pathways from poacher to trader to consumer, with fewer markup stages.

Research indicates that female traders predominate in bushmeat intermediary roles (90-93% of participants) and purchase bushmeat at fixed rates from poachers, with modest margins, thereby allowing poachers to capture 74% of the final sale prices in some markets.

Studies of bushmeat markets show that poachers supplying markets in Central African logging concessions can earn twice the income of junior technicians working at logging companies.

The Urban-Rural Economic Divide

The pricing relationship between bushmeat and beef inverts fundamentally between rural and urban contexts, creating dual market systems with distinct economic dynamics.

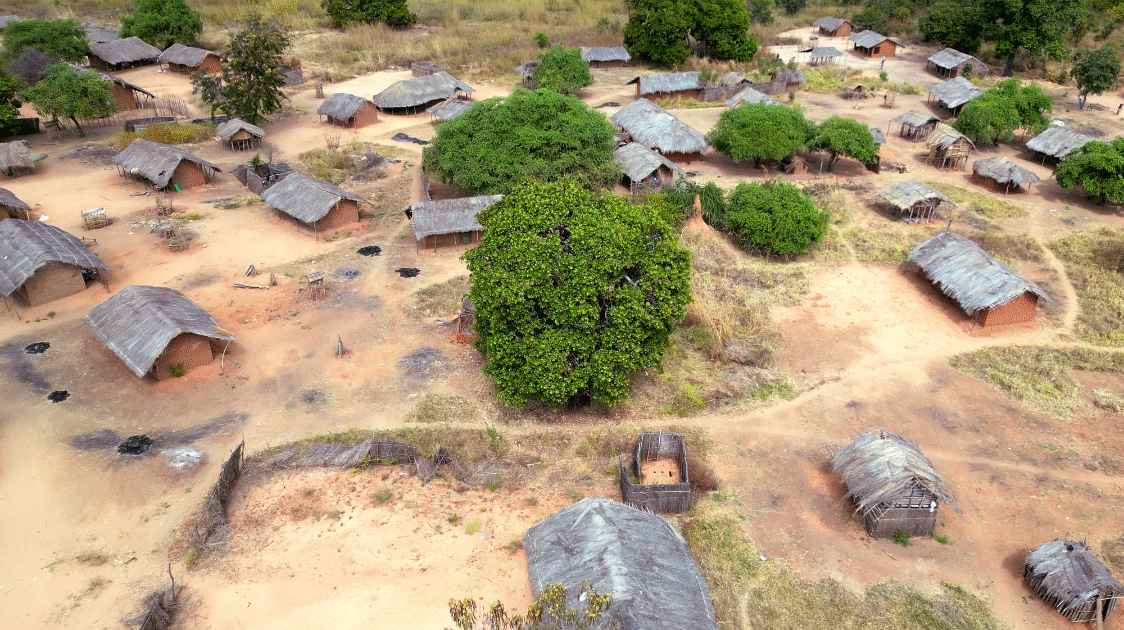

Rural areas often maintain traditional patterns, where bushmeat serves as a necessary protein for low-income households, typically costing significantly less than transported beef due to lower infrastructure requirements.

Rural pricing advantages for bushmeat stem from direct field access, minimal intermediary markups, and integration with traditional food systems.

Ghana's rural areas exhibit extreme dependence, with bushmeat accounting for 80-90% of animal protein intake in forest communities.

Congo Basin rural residents consume 51kg of bushmeat per capita annually, the highest global consumption rate, driven by both affordability and accessibility.

Urban markets transform bushmeat into a luxury commodity through several economic mechanisms.

Transportation costs increase substantially when moving from forest to city, while urban consumers often pay premiums for perceived quality and cultural authenticity.

Specific urban pricing data illustrates this transformation dramatically. Libreville, Gabon, shows premium bushmeat species costing $3.70/kg versus $2.30/kg for beef, while urban markets in Ghana price bushmeat 67-108% higher than beef.

This urban transformation creates significant economic opportunities for supply chain participants.

Poachers can earn an income comparable to that of wildlife service graduates in Ghana, while urban traders achieve profit margins of 25-37%, compared to much lower margins in rural trading.

The economic premium creates strong incentives for maintaining supply networks despite legal restrictions and transportation challenges.

Economic Accessibility and Food Security

Income levels and economic accessibility lead to significant regional variations in protein affordability and consumption patterns.

In rural Congo Basin communities, bushmeat accounts for 30 to 80% of total protein intake at costs significantly lower than domestic alternatives, serving as a critical food security safety net for populations earning less than $1.90/day.

Research shows that 71% of the population in low-income countries cannot afford healthy diets at $3.50/day, making affordable protein sources essential for nutritional adequacy.

Purchasing power analysis reveals significant substitution elasticity between protein sources in price-sensitive markets.

Ghana demonstrates strong price sensitivity, with consumers switching between fish and bushmeat based on relative costs.

Bolivia provides a dramatic example of price elasticity, where a 10% decrease in beef prices resulted in a 74% drop in bushmeat consumption, illustrating potential policy intervention points for protein market management.

However, economic relationships aren't uniform across regions.

Gabon exhibits inelastic bushmeat demand regardless of alternative protein prices, suggesting that factors beyond pure economics drive consumption patterns in wealthier contexts.

This economic complexity suggests that market interventions should consider local income levels and substitution possibilities.

Recent Market Trends and Future Outlook

The period from 2020 to 2025 has brought significant transformations to African meat markets, with COVID-19 catalyzing both disruptions and structural changes in the protein supply system.

Market corrections followed initial meat price spikes of 9% during 2020-2021; however, ongoing volatility persists due to supply chain fragility and climate-related impacts.

Country-specific data reveals substantial price increases across most regions. Kenya's retail beef prices range from $1.95 to $3.90/kg, while export-quality beef commands $3.30 to $4.50/kg, with beef consumption expected to grow by 3% or more annually through 2025.

Ghana's bushmeat markets continue to operate despite conservation pressures, with helmeted guinea fowl reaching $6.30/kg, while monkey species remain the cheapest at $2.10/kg.

Climate change impacts increasingly affect both protein sources economically.

Livestock face temperature sensitivity, with beef cattle production decreasing rapidly as temperatures rise, while 19 of 23 arid/semi-arid Kenyan counties experience worsening drought conditions.

These environmental pressures create additional cost pressures for formal livestock systems while potentially increasing reliance on wildlife-based protein sources.

Alternative protein development shows emerging potential, with the Middle East and Africa plant-based protein market reaching $15.7 billion in 2023 and projected to grow to $22.02 billion by 2030.

However, market penetration remains limited, and the infrastructure requirements for alternative proteins may face similar challenges to those affecting the beef industry.

Economic Implications for Policy

The economic analysis reveals that a sustainable protein policy for Africa must account for supply chain realities, rather than focusing solely on production costs or endangered species conservation goals.

Simple approaches that ignore infrastructure limitations and economic incentives consistently fail to achieve the intended outcomes.

Successful interventions must address the fundamental cost advantages that drive market behavior.

Infrastructure investment in cold chain logistics could enhance beef competitiveness, but it requires substantial capital investment and reliable energy systems.

Alternative approaches might focus on improving the sustainability and safety of existing low-cost protein systems rather than attempting to replace them entirely.

Future protein security for Africa's growing urban populations will likely require hybrid approaches that capture the cost efficiencies of traditional systems while building infrastructure for scalable, sustainable protein supply chains.

This economic transformation must acknowledge the substantial livelihood dependencies and community involvement within existing systems while working toward more sustainable protein provision to support Africa's projected population growth.

The economic evidence suggests that market forces, rather than regulatory approaches alone, will ultimately determine the evolution of Africa's protein systems.

Understanding and working with these economic realities offers the best pathway toward sustainable protein security for the continent's growing population.